- Financing solutions Connecting small business owners with financing solutions

- How it works Learn how we make the complex clear and the process seamless.

- About us We’re your dedicated small business financial partner.

Suzanne Robertson

About

Suzanne Robertson is a writer and editor based in Southern California. As a child, her father founded a law firm, allowing her to experience first hand the roller coaster ride of entrepreneurship while developing a deep respect for small business owners. Suzanne writes content specifically tailored to hard-working business owners and enjoys interviewing SmartBiz customers to learn about their journey. Suzanne always looks forward to spending time with her husband, two teenage daughters, and their rescue pup, Elvis Pawsley.

Background

Suzanne has worked as a writer and community manager for large brands, including WebMD, Disney Publishing Worldwide, iHeartMedia, and the Gannett/USA Today Network. She joined the marketing team of SmartBiz Loans in 2015 as the Senior Social Media and Marketing Content Writer. Her areas of expertise include small business financing options, small business operations, employee management, small business marketing, and more topics to help entrepreneurs improve their enterprise.

Education

Suzanne earned a bachelor’s degree in Journalism from Oklahoma State University. She completed internships for the U.S. Senate in Washington, DC, ABC affiliate KOCO-TV in Oklahoma City, and for NBC’s Late Night with David Letterman in New York before moving to Los Angeles. Qualified writers with a fintech background are welcomed to submit guest blog posts for consideration.

About the SmartBiz Editorial Process

Our writers and editors work hard to provide the most accurate and up-to-date blog posts. Our editorial process reflects our vision and standards and applies to all content. Learn more about how we write, edit, and fact check our posts:

Business Stories

December 10, 2015

Small Business Spotlight: E-ISG Asset Intelligence

Read More

Business Stories

December 03, 2015

The Tree Guy is Ready to Grow

Read More

Business Stories

November 25, 2015

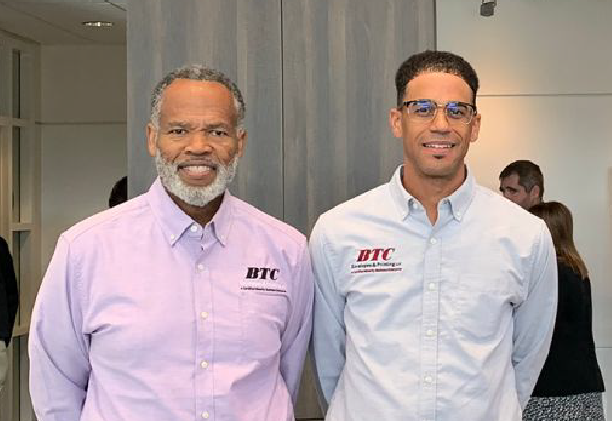

From Football Player to Entrepreneur: A Success Story

Read More

Business Stories

November 04, 2015

Customer Spotlight: Savory Gourmet Catering

Read More

Business Stories

October 20, 2015

New Lease, New Equipment: Two SBA Loans Help Fuel Expansion

Read More

Business Stories

September 28, 2015

Seafood Market Is Ready For Growth

Read More

Business Stories

September 26, 2015

One SBA Loan Helps Two Businesses Grow

Read More

Business Stories

September 15, 2015

An SBA Loan is Helping this Small Business “Clean Up”

Read More

Business Stories

August 21, 2015

Small Business Success Story

Read MoreAccess to the right loan for right now

See if you pre-qualify, without impacting your credit score. 1

Apply NowBack to Top

1. We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, SmartBiz Bank and the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may impact your credit score.

The SmartBiz® Small Business Blog and other related communications from SmartBiz BankSM are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial professionals for further information.